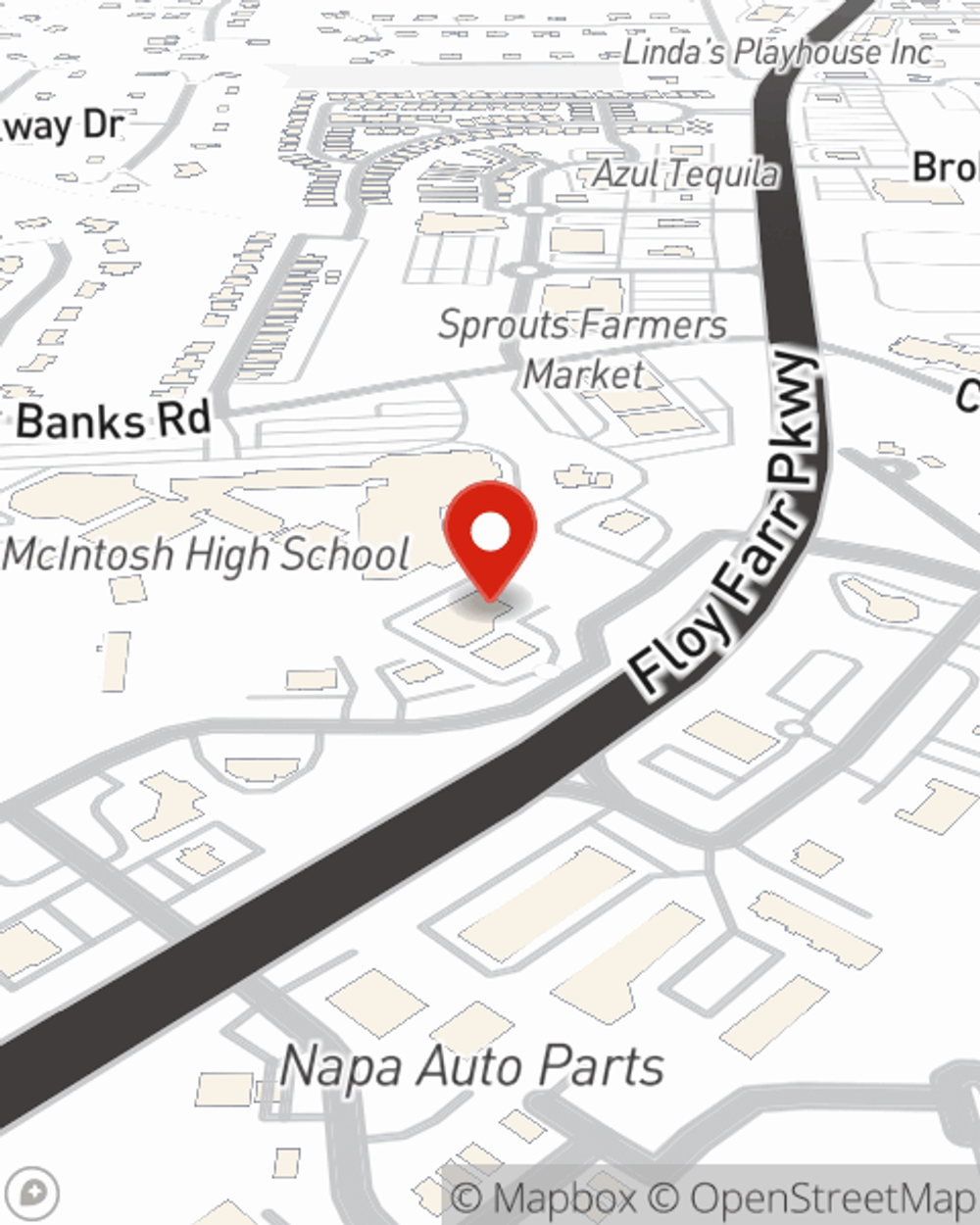

Business Insurance in and around Peachtree City

One of the top small business insurance companies in Peachtree City, and beyond.

This small business insurance is not risky

- Fayette County

- Fulton County

- Dekalb County

- Troup County

- Coweta County

- Clayton County

- Dougherty County

- Richmond County

- Carroll County

- Spalding County

- Rockdale County

- Henry County

- Gwinnett County

- Douglas County

- Forsyth County

- Macon County

- Lee County

- Upson County

- Colquitt County

- Lowndes County

- Greenville County

- Bibb County

- Meriwether County

- Houston County

Cost Effective Insurance For Your Business.

Small business owners like you have a lot on your plate. From customer service rep to inventory manager, you do as much as possible each day to make your business a success. Are you a pharmacist, a psychologist or a barber? Do you own a bridal shop, a dance school or a book store? Whatever you do, State Farm may have small business insurance to cover it.

One of the top small business insurance companies in Peachtree City, and beyond.

This small business insurance is not risky

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, surety and fidelity bonds or artisan and service contractors.

As a small business owner as well, agent Tarcia Troup understands that there is a lot on your plate. Visit Tarcia Troup today to discuss your options.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Tarcia Troup

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.