Homeowners Insurance in and around Peachtree City

If walls could talk, Peachtree City, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Fayette County

- Fulton County

- Dekalb County

- Troup County

- Coweta County

- Clayton County

- Dougherty County

- Richmond County

- Carroll County

- Spalding County

- Rockdale County

- Henry County

- Gwinnett County

- Douglas County

- Forsyth County

- Macon County

- Lee County

- Upson County

- Colquitt County

- Lowndes County

- Greenville County

- Bibb County

- Meriwether County

- Houston County

Home Is Where Your Heart Is

Your home and property have monetary value. Your home is more than just a roof and four walls. It’s all the memories you’ve made there. Doing what you can to keep your home protected just makes sense! That's why one of the most sensible steps is to get excellent homeowners insurance from State Farm.

If walls could talk, Peachtree City, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Open The Door To The Right Homeowners Insurance For You

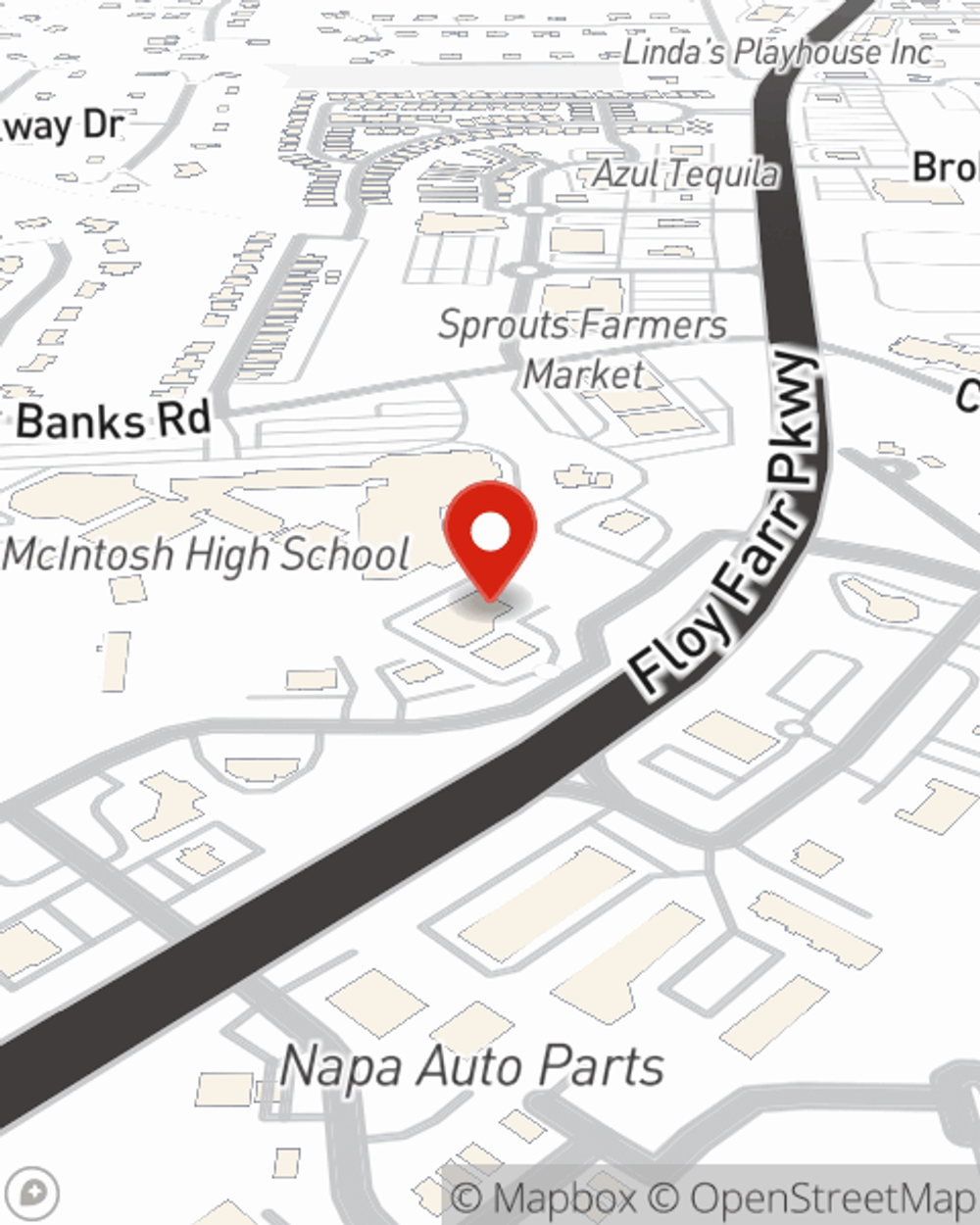

Agent Tarcia Troup has got you, your home, and your memorabilia guarded with State Farm's homeowners insurance. You can call or go online today to get a move on setting up a policy that fits your needs.

Having terrific homeowners insurance can be valuable to have for when the unanticipated occurs. Get in touch with agent Tarcia Troup's office today to put together the right home policy.

Have More Questions About Homeowners Insurance?

Call Tarcia at (678) 788-7650 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.

Tarcia Troup

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.